|

| ||||||||

|

|

Calendar Icon |

|

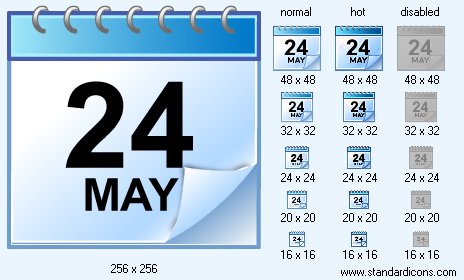

Icon sizes: 256x256, 48x48, 32x32, 24x24, 20x20, 16x16

File formats: ICO, GIF, PNG, BMP

Tags: cruzer icon, phone icon, 90's fashion icon, xbox gamer icons, cute computer icons

Necessarily get a calendar of the bookkeeper. It can be found in shops of the specialised literature. The Internet to look in the printing editions devoted to book keeping, to ask at acquaintances. In him it is specified, what taxes and when to pay, when what declarations to hand over. At the wrong time handed over reporting is the penalty, at the wrong time paid tax it it. A calendar hang up at a desktop in a prominent place. At once attentively see it and allocate with colour all dates concerning activity of your organisation. Then bring them in the daily log. It is necessary to bring not last afternoon delivery of the reporting or tax payment, and in good time. Approximately for a week-one and a half.Defines book keeping at the enterprise the order on the registration policy. The order is accepted in the beginning of activity and further each time in the beginning of new calendar year is updated. Its serial number one of the first. The document very serious. As you can see, variants of book keeping of the same action a little. And it is possible to apply only one principle in the account and to change it it is impossible within all calendar year. The base order on the registration policy, placed on the Internet, consists of 120 pages. Then it correct, considering requirements of the organisation. It is desirable to charge preparation of the given order to the skilled bookkeeper.

Let's separately disassemble the VAT. In spite of the fact that everything pay it not, to know calculation principles it is necessary. It is easier to talk to clients who consider the VAT in the calculations. The tax the biggest. For 2005 makes 18 % from goods or service cost. The tax very transparent, is easily supervised. The profit tax formally is more (24 %), but it can be absent following the results of activity of the enterprise or to be minimum. From the VAT usually not to get to anywhere. Once again I pay attention, it can make to 18 % from your turn.

The VAT it the value-added tax. We will consider VAT occurrence on points.

1. The enterprise creates any product for which manufacture raw materials and materials are used, water and the electric power are spent warmly. That is industrial expenses are carried out. Further this product is on sale to the consumer. The sale price includes industrial expenses (cost price) and profit (the added cost) given manufacture.

Copyright © 2009-2022 Aha-Soft. All rights reserved.

|