|

| ||||||||

|

|

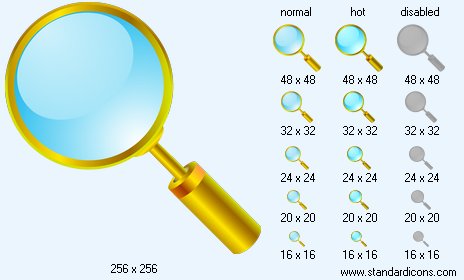

Yellow Magnifier Icon |

|

Icon sizes: 256x256, 128x128, 48x48, 32x32, 24x24, 20x20, 16x16, 512x512

File formats: ICO, GIF, PNG, BMP

Tags: girls aim icon, myspace lyrics icons, yellow exclamation point icon, travel icons, cheats for def jam icon for xbox 360

That if you are accused of professional incompetence. The client can achieve that from it? That you will be responsible for the caused monetary damage.Nensi Piat, the lawyer and the author of the grant for legal advisers (published by Library of advisers), describes three kinds of a damage: direct, arising subsequently and retaliatory. The direct damage is put to people or the property. The damage arising subsequently, is formed indirectly that you have missed something. Retaliatory is the damage put for swindle, malfeasance, an arbitrary use of power or default of duties (that will be still discussed in the given book). The problem of recommendations resulted here consists in saving you from any – connected with drawing of a damage of the claims which are put forward against you by the client. Even if the claim never will get to court or will be settled prior to the beginning of proceeding, you will have big troubles, and you will incur the considerable expenses connected with protection against the claim and payment of legal fees.

Before starting standards in which frameworks you can legally work, we will make small deviation that you have realised two errors supposed by many advisers,

Thinking as if they will manage to protect from proceeding and-or to be protected from a legal damage.

The first error consists in your hopes of the insurance from the insurance company for any proceeding which you will lose. Offered policies are similar on what are bought by doctors on a case of negligent treatment, however between them there is also a difference. The insurance policy offered the adviser, is called as the policy «errors and omissions». It is supposed that it will protect you also, as well as the doctor (remember that doctors pay now the payments making more of $75.000 year because of what many refuse practice).

As it appears, the policy «errors and omissions» is very similar to an insurance policy from flooding: if you live on a height, it is not necessary, and if in lowland, the insurance company will not give out it to you. If to you offer the policy «errors and omissions», attentively it read; you will see that payments are too great, as well as deduction, and refutations easily enough release the company from all risks. Instead in the given book ten recommendations, reducing risk of responsibility for professional incompetence at least on 90 % are given. They are taken from ethical practice of the succeeding advisers, working years 30 and never having legal problems with clients.

Copyright © 2009-2022 Aha-Soft. All rights reserved.

|