|

| ||||||||

|

|

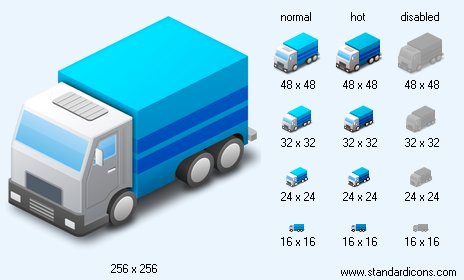

Blue Van Icon |

|

Icon sizes: 256x256, 48x48, 32x32, 24x24, 16x16, 512x512

File formats: ICO, GIF, PNG, BMP

Tags: love icons graphics, rearrange menu bar icons, desktop icons displaying wrong image, white music icons, kahne icons

Trusts and a company amalgamation facilitated a way to achievement of economy from scalesProductions, but, if organizational costs of the consolidated companies

Surpassed economy from production expansion, these companies did not survive.

There is nothing surprising that to wide trade in shares of the industrial

The companies trade in certificates of the trusts manufactured in 1880 preceded

Years Sears, "Rise of the Market", pp. 112 - 121 and Navin. Some trusts Were great enough to support an active market on the shares, and them

Popularity reflected submission what to suppress a competitiveness and is possible, and

Favourably, also that large-scale production is more economic than the small. By the end

1880th years trade in certificates of trusts has found scope. New York

The stock exchange allowed the members to trade in them as not quoted valuable

Papers as was considered that uncertainty of a legal status does

Their unsuitable for quoting at exchange. Though certificates of trusts were considered

Very speculative papers, the history of market prices begins with them and Dividends on the industrial shares, distinguished from railroad shares And the public service companies. After 1891, when accepted in

Legal status, their shares have immediately acquired the status quoted on To the New York stock exchange. Capital structure in the incorporated trusts was absolutely other, than in To modern practice. Usual though and not universal practice, was

Capitalisation of the trust of level of incomes reached by the companies in shape

The preference shares which have been thought up as a method of warranting of investments

p. 164 - 167,

Industrial Finance, Practice of creation of corporations in Britain was similar also. See: Cottrell. Ordinary shares were manufactured with allowance for

Risk of eventual losses and prospect of profits in the future. Though at Capitalisations of railways followed the same scheme, many foreign Observers believed that usual shares of corporations absolutely "it" or Do not represent "anything except the sky blue". According to these Observers, the income of corporations on usual shares was not so much result Hazardous speculations, how many a consequence unscrupulous it clients. - and Sirs for the period with 1890 for 1893 transfer twenty eight Issues of preference shares table 1, Sears, p. 118, Navin and "Rise of the Market". At that time investing bankers familiar mainly with Railway shares, yet quite trusted in investment dignities Industrial securities; and they participated in trade only five of Twenty two issues actively forcing the way on the market. It. P.Morgan,

Copyright © 2009-2022 Aha-Soft. All rights reserved.

|