Program Icons

Downloads

Get icon software

and icon graphics!

perfecticon.com

Windows Icon

Collections

More than 99999

icon files.

Low price

& High quality.

www.777icons.com

Toolbar

Icon Images

Download thousands

of toolbar and menu

icons now!

toolbar-icons.com

Website Icons

Search web

icons. Download

icon sets.

perfect-icons.com

Downloads

Get icon software

and icon graphics!

perfecticon.com

Windows Icon

Collections

More than 99999

icon files.

Low price

& High quality.

www.777icons.com

Toolbar

Icon Images

Download thousands

of toolbar and menu

icons now!

toolbar-icons.com

Website Icons

Search web

icons. Download

icon sets.

perfect-icons.com

|

| ||||||||

|

|

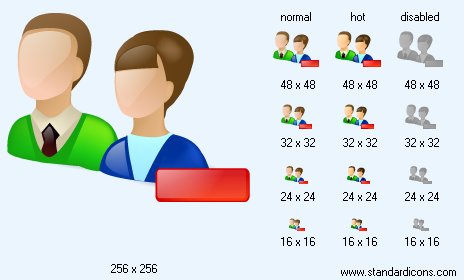

Remove Users Icon |

|

Icon sizes: 256x256, 48x48, 32x32, 24x24, 16x16

File formats: ICO, GIF, PNG, BMP

Tags: globesurfer icon ii 7.2, music online icons, my computer icon windows 2000, os x icon packages, teddy geiger buddy icons

If the worker carried out payment of payments within 35 and more years it couldTo receive the maximum pension equal of 70 % of the monthly salary. Base pension

Corresponded 50 % of the monthly base salary.

_3. Pensions of Insurance cash desk of private employees _

The same as and in it, internal statute it established that for Calculations of the base salary according to which the pension paid off on Old age, the nominal incomes subject to taxation and corresponding To the first 24 months from the last during which the insured worked, Should be recalculated with certain factor. In this case

The recalculation factor was equal to the relation between the basic earnings in Santiago

In each of the above-named months and last of 60 considered.

As the basic salary changed irrespective of it, the same took place

The phenomenon, as in a case with it when the recalculation factor could be above

Or more low it. For maintenance of independence of calculations from the tactical

Fluctuations which could affect estimations resulted more low, is accepted, That the above-named factor of recalculation applied by first 24 months, Changes in the same proportion, as it.

Old-age pensions and for long service, calculated for clients it for a moment

Retirement, are shown in table 1.9.

The incomes which are subject to taxation (in it. To currency)

The maximum size of pension (in it. To currency)

The maximum size of pension in % to the income, taxable

25.000

21.698

86,8

40.000

34.717

86,8

70.000

60.755

86,8

120.000

104.151

Copyright © 2005-2022 Aha-Soft. All rights reserved.

|